Energy bills have become a bit of a wild card lately. One month you’re cruising, the next you’re staring at a spike that makes no sense. And if you’re managing a multi-tenant property or running a business with high operational overhead, those fluctuations aren’t just annoying—they’re disruptive.

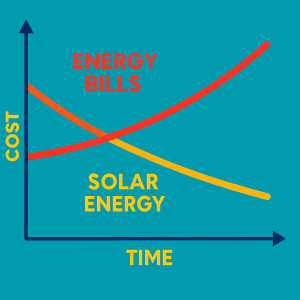

That’s why more property owners are turning to solar. Not because it’s trendy. Not because it looks good on a sustainability report. But because it’s a strategic move toward control, predictability, and long-term savings.

The Grid’s Got Issues—and You’re Paying for Them

Utility rates aren’t just rising—they’re ricocheting. In regions like the Mid-Atlantic and parts of the Southeast, grid instability is becoming a regular headache. Aging infrastructure, seasonal demand surges, and unpredictable fuel costs all funnel down into one thing: higher bills for you.

And here’s the kicker—those rate hikes often have nothing to do with your actual energy use. You’re essentially paying for someone else’s inefficiencies.

Solar flips that dynamic. It’s like switching from a shared taxi to your own car. You control the route, the speed, and the cost.

Solar Isn’t Just About Panels—It’s About Leverage

Installing solar isn’t just a technical upgrade. It’s a financial strategy. You’re not just generating power; you’re generating leverage.

- You lock in predictable energy costs for 20+ years.

- You reduce exposure to volatile utility pricing.

- You gain negotiating power with tenants and buyers who value energy-efficient properties.

And if you’re in a deregulated market? Solar gives you even more room to maneuver. You can pair it with battery storage, peak shaving strategies, or even sell excess energy back to the grid (depending on local policies).

It’s not magic—it’s math. And it works.

Let’s Talk ROI—Because That’s What Actually Matters

The upfront cost of solar can feel like a hurdle. But when you break it down, it’s more like a speed bump.

Most commercial systems pay for themselves in 5 to 7 years. After that, it’s pure margin. And with federal incentives like the Investment Tax Credit (ITC) still hovering around 30%, plus accelerated depreciation under MACRS, the financial case is stronger than ever.

Honestly, if you’re still waiting for a “better time,” you might be waiting through another five years of rate hikes.

A Quick Tangent on Tenant Retention

You know what tenants hate? Surprise costs. You know what they love? Stability.

Solar-powered buildings offer predictable utility costs, which makes lease negotiations smoother and retention stronger. It’s not just about being green—it’s about being smart.

And if you’re managing senior living facilities, medical offices, or educational campuses? Energy reliability isn’t just a perk—it’s a necessity.

Seasonal Trends and Timing

Fall is a great time to start planning. Cooler weather means easier installation logistics, and you’ll be positioned to capture winter sunlight when demand spikes. Plus, many solar providers offer Q4 incentives to close out the year strong.

If you’re budgeting for 2026, now’s the moment to pencil in solar. Not just as a line item—but as a strategic pillar.

Final Thought: Control Isn’t a Luxury—It’s a Business Imperative

Grid independence isn’t about going rogue. It’s about being resilient. It’s about saying, “We’re not going to let someone else’s infrastructure dictate our margins.”

Solar gives you that control. And in a market where every percentage point matters, that control is worth its weight in kilowatts.

Leave a Reply